We often focus our financial energy on the “big” expenses like rent, car payments, or that long-awaited summer vacation. While these significant outflows certainly impact our bank accounts, it is rarely the large purchases that cause our budgets to unravel. Instead, wealth is often eroded by a series of small, quiet leaks that operate in the background of our daily lives. These unnoticed monthly money losses might seem insignificant on their own, but when compounded over a year, they represent a missed opportunity for savings, investments, or experiences that truly matter.

What Are Unnoticed Monthly Money Losses?

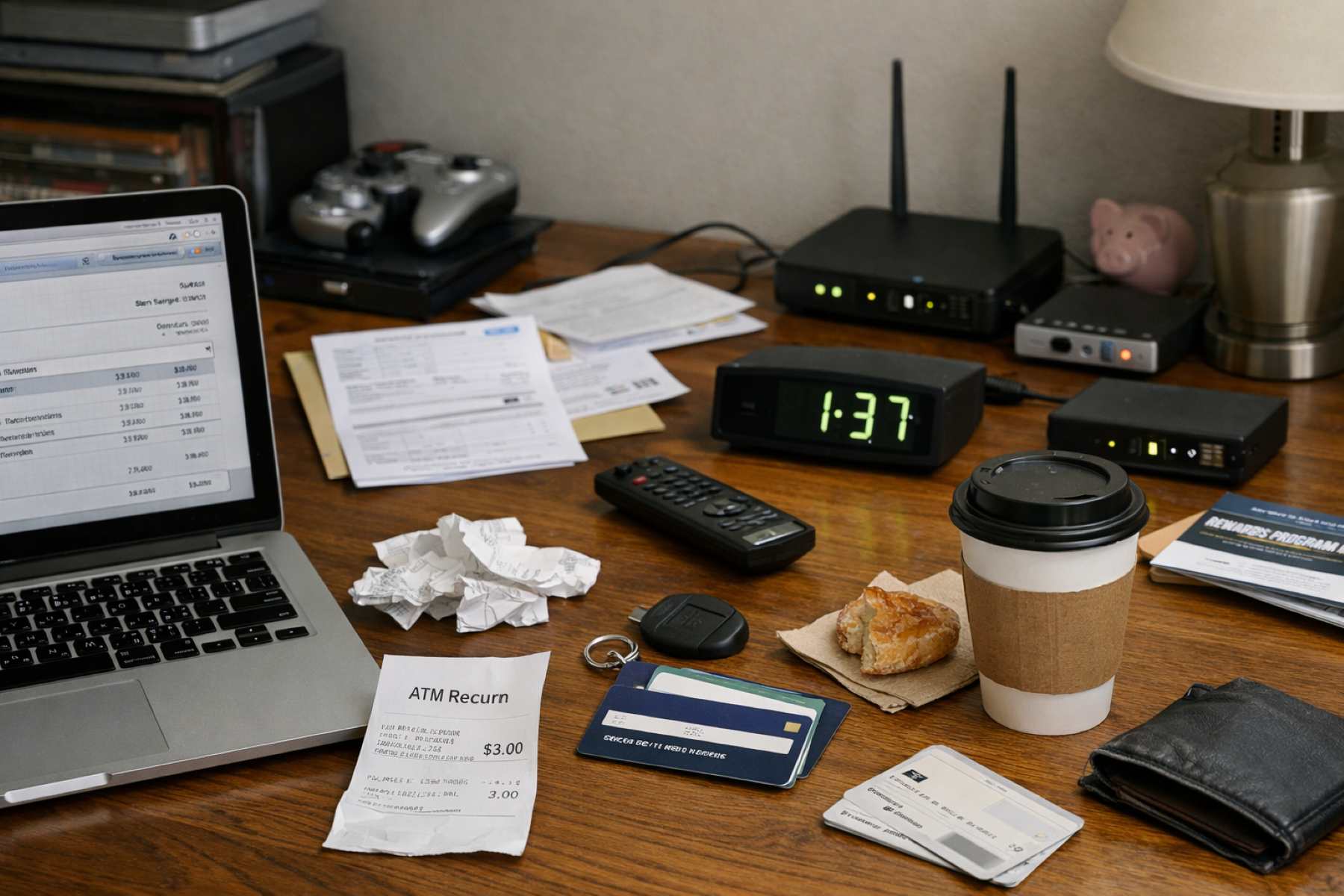

Before we dive into the specific culprits, it is helpful to define what we mean by unnoticed monthly money losses. These are recurring expenses that have become so integrated into our routine or automated systems that we no longer “feel” the transaction. Unlike a grocery bill where you physically see the total at the register, these losses often happen behind the scenes through digital autopay, hidden fees, or passive habits. Recognizing these leaks is the first step toward regaining control of your financial narrative and ensuring your hard-earned income stays exactly where it belongs.

1. The Heavy Burden of Unused Subscriptions

In the modern digital economy, the subscription model has become the standard for everything from entertainment to fitness and software. While these services offer incredible convenience, they also rely on a “set it and forget it” mentality. Many of us sign up for a free trial or a niche streaming service for one specific show, only to leave the monthly charge running for years after we’ve stopped using it.

These fees accumulate quietly, often hidden among dozens of other line items on a credit card statement. Taking an hour once a month to audit your digital subscriptions can reveal significant savings. If you haven’t opened the app or used the service in the last thirty days, it is likely time to hit the cancel button. You can always resubscribe later, but there is no reason to pay for a service that isn’t providing active value to your life.

2. The Quiet Sting of Hidden Bank Charges

It is easy to assume that our banks are simply safe harbors for our money, but they are also businesses with complex fee structures. One of the most common ways people lose money is through overdraft charges and monthly maintenance fees. These charges often trigger when a balance dips just slightly below a required threshold or when an automated payment processes a day before a paycheck hits.

Because these fees are often deducted automatically, they can go unnoticed for months. Many modern banking institutions offer “no-fee” accounts or will waive charges if you set up a direct deposit. A quick phone call to your bank or a switch to a more consumer-friendly credit union can instantly plug this leak. Being proactive about understanding your bank’s fine print ensures you aren’t paying a premium just for the right to access your own cash.

3. The Cumulative Cost of Impulse Splurges

We all have those small daily rituals that bring us joy, such as the morning visit to a favorite coffee shop. While there is nothing wrong with enjoying a premium latte, these impulse splurges can add up to a staggering amount over time. When we tap our phones or cards for a five-dollar drink, the psychological “pain” of spending is minimal, making it easy to repeat the behavior without thinking.

When you calculate the monthly total of these daily habits, you might find you are spending hundreds of dollars on convenience. The goal isn’t necessarily to eliminate these treats entirely but to move them from “impulse” to “intentional.” By brewing coffee at home a few days a week or setting a specific “fun money” budget, you can still enjoy your favorite perks without allowing them to quietly drain your savings account.

4. ATM Convenience Fees That Drain Your Balance

Convenience is a valuable commodity, but it often comes with a steep price tag in the form of ATM fees. When you use an automated teller machine outside of your bank’s network, you are often hit with a double charge: one from the machine owner and another from your own bank. Paying three to five dollars just to access twenty dollars of your own money is a high-interest mistake.

These small transactions are classic examples of unnoticed monthly money losses because they feel like “one-time” occurrences. However, if you make this a habit just twice a week, you could be losing over forty dollars a month. Planning ahead by withdrawing cash at your home bank or using the cash-back option at a grocery store can save you a significant amount of money with very little extra effort.

5. The Forgotten Trap of Auto-Renewal Memberships

Among all the financial leaks, forgotten auto-renewal memberships are perhaps the most ignored. This goes beyond simple digital streaming; it includes professional organizations, gym memberships, annual software licenses, and magazine subscriptions. Because many of these renew annually rather than monthly, they often hit our accounts as a “surprise” charge that we simply shrug off and accept.

This specific loss is often ignored because we convince ourselves we might use the membership “someday.” However, if a year has passed and you haven’t engaged with the organization or service, the membership is no longer serving you. Setting a calendar reminder a week before major annual renewals gives you the opportunity to evaluate the service’s worth. Breaking the cycle of automatic renewals forces you to make a conscious decision about where your money goes.

6. The Ghost of Utility Standby Power

Many homeowners are surprised to learn that their electronics continue to draw power even when they are turned off. This phenomenon, often called “vampire energy” or standby power, occurs because devices like televisions, computers, and kitchen appliances remain in a ready state to respond to remote controls or internal clocks. While the draw per device is small, the collective impact on your monthly utility bill is measurable.

This is a literal “quiet” drain on your finances. Utilizing smart power strips that cut off electricity to non-essential devices when they aren’t in use can lower your monthly energy costs. Additionally, being mindful of your thermostat settings and ensuring your home is properly insulated can prevent your hard-earned money from literally floating out the window. Small adjustments to your home environment lead to consistent, effortless savings.

7. The Loss of Expiring Loyalty Points

Loyalty programs and credit card rewards are designed to give money back to the consumer, yet billions of dollars worth of points expire unused every year. We often view these points as “bonuses” rather than actual currency, which leads us to forget about them until it is too late. Whether it is airline miles, hotel points, or grocery store rewards, letting these expire is essentially the same as leaving cash on the table.

To prevent this, it is helpful to treat your loyalty points with the same respect as your savings account. Use a tracking app or a simple spreadsheet to keep an eye on expiration dates. By strategically using these rewards for travel or everyday purchases, you can offset your regular spending and keep more of your monthly income in your pocket.

Taking the time to identify unnoticed monthly money losses is not about living a life of restriction; it is about practicing financial mindfulness. When we stop the leaks, we find ourselves with more resources to put toward the things that truly enrich our lives—whether that is building an emergency fund, investing in a hobby, or simply enjoying the peace of mind that comes with a balanced budget.